Benefits & Retirement Services

Providing expert assistance to ease the administrative burdens of offering benefits.

For all clients regardless of PEO (on our Tax ID) or non-PEO relationship (often referred to as ASO – Administrative Service Organization on client’s Tax ID), here are some of the most common services we offer. Please get in touch with us to learn more about how we can help you.

Why Comp Central?

Reasons to Use Our Employee Benefits & Retirement Solutions

Customized Benefits

Attracting and keeping the most productive and profitable employees it a difficult task. Comp Central can implement a customized benefits package tailored to your business’ unique needs that helps retain key employees and keep them happy.

Easy Enrollment

Whatever benefits you want to offer, we will run the program efficiently and cost-effectively – eliminating any worries on your part. Mobile enrollment and benefit tutorials make it easy and affordable.

Connect & Engage Through The App

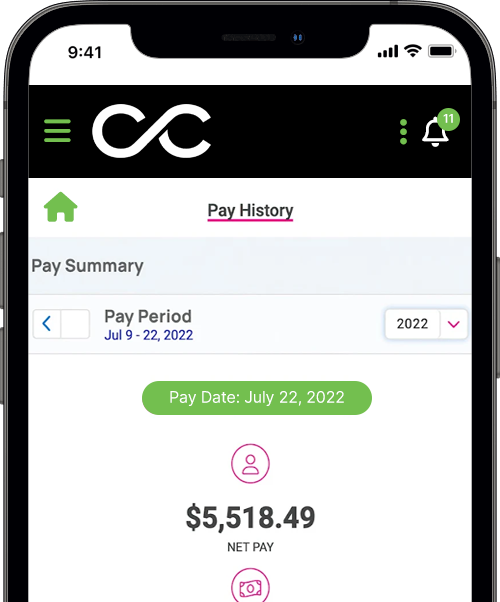

Provide instant access anywhere to benefits information including co-pays, networks, exclusions, and portfolio management.

Features

Comp Central offers a full suite of services to simplify employee benefits and retirement.

Skip the Administrative Hassles

Whether you join our group plan or we customize a benefits program for you, we’ll administer it and provide expert assistance to ease the administrative burdens of offering benefits.

A Comprehensive Selection of Benefits

With Comp Central, you can offer your employees desirable benefits from carriers they know and trust.